In an era of constant change and complexity, strategic financial management is becoming an essential discipline for navigating uncertainty and enabling long-term success.

We will start with a reminder of the key contrasts between traditional accounting and financial management:

- Accounting is about reporting whilst financial management focuses on control.

- Financial management is forward looking, accounting is backward looking.

- Accounting looks inward, financial management outward.

- Financial management is dynamic, where accounting is static.

The financial management model is designed to serve the needs of the people who make and monitor decisions.

The 2020s is so far, an era of heightened risk, as global policy shifts and economic uncertainty sky rockets. To help organisations to survive in a rapidly changing environment financial managers should be honing various skills – most notably the three As:

- Awareness

- Anticipation

- Adaptability

Alongside this sits the issue of data and information management. Financial managers are increasingly becoming custodians of large swathes of an organisation’s information systems.

1. 📈 Awareness

The more rapidly the world changes, the more attention needs to be paid to it. Awareness calls for monitoring information, covering what is happening, or to be precise, what has been happening recently.

Accountants are already very good at looking inward and asking questions, for example what did we sell last month? At what margins? And so on.

Outward looking awareness covers issues such as the trend in our market share, and how our pace of innovation compares with competitors'.

2. 🔮 Anticipation

This refers to anticipation of future changes. If you can see change coming, it can provide opportunities. When it takes you by surprise, it is more likely to bring problems.

Anticipation, for accountants, often involves forecasts, of which there are two kinds:

- Relationship forecasts: For example, the relationship between price and volume (elasticity of demand). These are key inputs to decision making - in this case setting an optimum selling price.

- Outcome forecasts: These show the anticipated outcome of decisions, for example, having decided on a pricing policy, what volume do we expect to sell and when?

Forecasts then provide a benchmark against which to compare actual outcomes, which offers organisations feedback and an opportunity for learning.

The two kinds of forecast overlap, in the sense that one manager's forecast outcome is another manager's key relationship:

If a production manager forecasts shorter lead times, as a consequence of an investment in equipment, then the sales manager needs to review the assumed relationship between volume and price. The resulting amendment to the sales forecast is then an input to the production plan.

Another key area of anticipation for accounts is changing regulation and policy. As US President Mr trump has recently demonstrated government shifts can mean major changes for affected organisations.

3. 🔄 Adaptability

Heightened awareness and anticipation will be pointless, unless the organisation is able to adapt accordingly. Financial managers must be on the lookout for obstacles to agility, for example rigid annual budgets in an accounting format!

Adaptability calls for decision support information. Essentially, information for a particular decision should show the forecast outcomes of various feasible choices and identify those that offer the best value for the business.

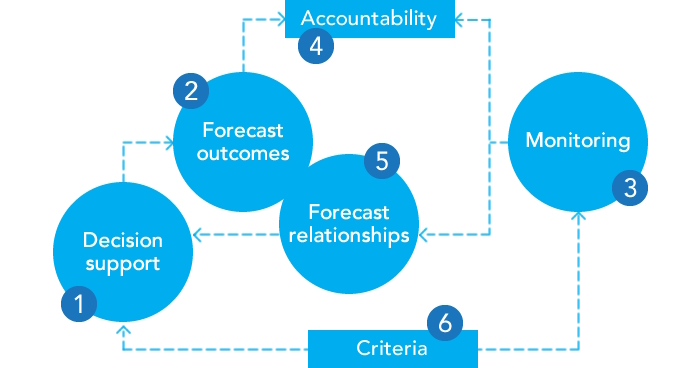

The significance of the various kinds of information available to financial managers becomes apparent when we relate them in the form of a chart showing the elements of control:

The elements of control

Types of information:

- Decision support: Here we need to pull in relationship forecasts such as price/volume and volume/cost. These will tell us the incremental contribution, at various price points, facilitating a decision.

- Forecast outcomes: Having made the decision the expected outcomes, in terms of sales, will be a matter of calculation. This will be a useful input for a manager seeking to plan capacity. This sphere comprises the budget for the foreseeable future.

- Monitoring: Here we compare, amongst other things, what actual sales are. By comparing this figure with the expected outcome, two results follow.

- Accountability: Firstly, it provides a framework for the sales manager’s accountability. They will need to interpret and explain the reasons for the difference.

- Forecast relationships: Secondly, it provides feedback into this sphere - a realisation that demand is more or less elastic than was thought.

- Criteria: The important thing here, in our final element, is that the same criterion should be used for both making and then monitoring decisions.

Great financial management can be absolutely core to helping your organisation achieve its wider objectives.

You need to sign in or register before you can add a contribution.