Last week, we trawled through the darkest corners of the ledger – stories of accountants who used their powers to fund lavish lifestyles and pernicious vices. Some of the stories were glamorous and involved Goyte, others were council workers stealing from the piggybank for the new playground.

Now it’s time to turn our eyes to the light, to consider finance professionals who stood up for what was right, even if risk-based analysis suggested it might torpedo their career prospects. So, let’s get started!

🎵 Sherron Watkins & Cynthia Cooper – The Whistleblowers

In the early 2000s, two accountants – both women, both in high-ranking positions – spotted something rotten in the spreadsheets.

Sherron Watkins, Vice President of Corporate Development at Enron, noticed accounting irregularities in 2001. She wrote a now-famous internal memo to chairman Ken Lay which reads more like a threat.

A snippet: "Don't you think that several interested companies, be they stock analysts, journalists, hedge fund managers, etc., are busy trying to discover the reason Skilling left? Don't you think their smartest people are pouring over that footnote disclosure right now? I can just hear the discussions now…” It feels like it should’ve been written from magazine clippings!

Around the same time, Cynthia Cooper, VP of Internal Audit at WorldCom, uncovered an $11 billion black hole in the books. After some unsatisfying answers, Cynthia had her team begin an investigation. And they worked secretly, through the night, tracing the issue to false accounting entries that had been running for years. Executives were classifying everyday expenses as capital investments to inflate profits – a bit like claiming your morning coffee as office furniture.

Neither woman went public immediately. They raised concerns through the proper internal channels, which were obviously ignored, until the stocks tanked and congressional hearings demanded names.

The scandals at Enron and WorldCom led to the Sarbanes-Oxley Act of 2002, the most sweeping corporate reform law in a generation. It created new rules for audit oversight, forced CEOs to sign off on their accounts, and finally gave whistleblowers legal protection.

In 2002, Time Magazine named Watkins and Cooper – along with FBI lawyer Coleen Rowley – as their Persons of the Year, under the cover title "The Whistleblowers”, which admittedly does sound a bit like a band your dad would listen to.

Photo: TIME Magazine

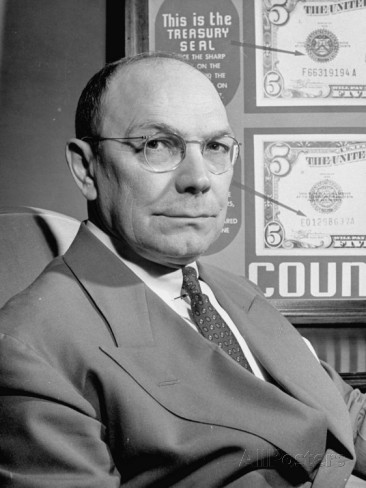

🔫 Frank J. Wilson – The Real Untouchable

Al Capone once said, "You can get more with a kind word and a gun than with a kind word alone.” Undeniably true, but perhaps a bit much when you just want your nan to pass the salt.

But Capone got a lot his way. He had massive political influence over his city of Chicago. But it wasn’t the gun that got Capone, it was sloppy accounting.

It was Frank J. Wilson, a bespectacled agent with a head for numbers, who discovered Capone’s scam. Wilson didn’t make headlines like Eliot Ness, nor was he in the film The Untouchables, but it was his obsessive document review – over two million financial records – that cracked the case.

Capone was living like a king, and it was known to everybody. He wore custom suits, sipped fancy champagne, and lived his life in hotel suites. However, his income was pretty average, and he paid tax that matched. But illegally obtained income is still taxable so, when Wilson read the phrase, "Frank paid $17,500 for Al”, he knew there would be more evidence.

From there, Wilson tracked bank deposits, decoded handwriting, and convinced terrified witnesses to testify. In 1931, Capone was convicted on 23 counts of tax evasion and sentenced to 11 years in Alcatraz.

It was the birth of forensic accounting, and a reminder that criminals always leave a financial footprint, even if you can’t get them on their baseball bat-related offences.

Photo: Huitzilopoc, CC BY-SA 4.0 via Wikipedia Commons

🔎 Harry Markopolos – A Weekend At Bernie’s

Have you ever warned people things are going to go wrong and be ignored, only to be proven right soon afterwards? Well, imagine being Harry Markopolos.

A financial analyst and self-described "maths geek,” Markopolos started looking into Bernie Madoff’s too-good-to-be-true investment returns in 1999. Within five minutes, he knew it was nonsense; within four hours, he’d proven it mathematically. For reference, it was late 2008 that Madoff’s fraud was officially discovered.

That’s not to say that Markopolos sat on this information. He submitted reports to the SEC as early as 2001. In 2005, he even titled one, The World’s Largest Hedge Fund is a Fraud. But nothing happened. Greed talks, and Madoff was a Wall Street darling, while Markopolos – eccentric, insistent, and forensic – was easy to dismiss.

When Madoff’s empire finally collapsed in 2008, Markopolos was vindicated, but he wasn’t Time Magazine Person of the Year – that honour went to Barack Obama, who was having quite a good year, to be fair.

He quit fund management to pursue fraud investigations full-time. And yes, someone really should make the movie.

🇷🇼 Post-Genocide Rwanda – Creating A Nation

After the 1994 genocide, Rwanda was in ruins. The capital had no roofs, no toilets, and no functioning financial system. Even the banks didn’t use proper accounting. So, they had to start from scratch.

In 2008, Rwanda established the Institute of Certified Public Accountants (iCPAR) to train and regulate a brand-new profession. With help from CPA Ireland, they built local qualifications, set up audit standards, and introduced modern financial controls across government and business. They even adopted international accounting standards to bridge old divisions and prevent future conflict.

Today, Rwanda is considered a regional model of transparency and financial reform. Turns out, rebuilding a country doesn’t just take a village – it takes accountants.

🧠 Final Thoughts

Accountants are genuinely very powerful. It’s hard to imagine a society without us. All too often, we hear about the ones that went bad, or they served a bad cause, but there are really important stories of accountants bucking that trend.

So, when a psychotic mob boss is put behind bars, or a nation torn apart is being rebuilt by accountants, it’s a good reminder that our skills can be used for something special.

Worth keeping that in mind next time you log in to do your CPD.

You need to sign in or register before you can add a contribution.