Who must prepare group accounts and whether they’re required to do so may depend on a number of factors. There is no uniform rule across the world as to when group accounts must be prepared.

In some countries, the requirement to prepare group accounts is driven by the requirements of legislation. In others there may be a mandatory requirement to prepare group accounts whenever the entity is either a parent at the reporting date or has been a parent during the reporting period. It is important that each preparer obtains a sound understanding of the requirements in their jurisdiction.

Some countries, such as the United Kingdom and Ireland, require group accounts to be prepared when the group is a medium-sized or large group. Classification as medium-size or large is dependent on levels of turnover, balance sheet total and number of employees.

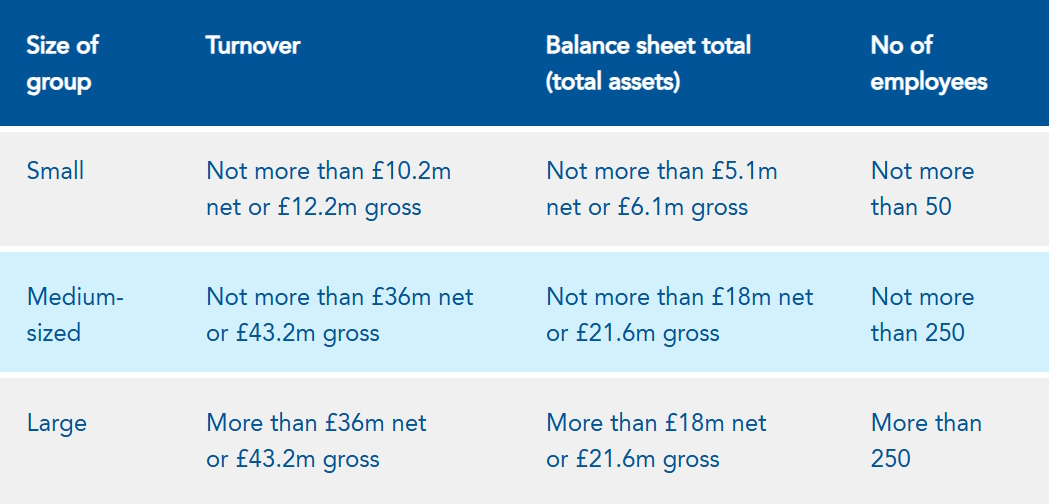

Under section 399 of Companies Act 2006, a UK company is required to prepare group accounts if, at the end of the financial year, that company is a parent entity and cannot claim any exemptions from this requirement. One such exemption is if the group is small and so it is important to determine the size of the parent and group correctly. At the time of writing, the size thresholds in the UK are as follows:

UK Group Size Thresholds

On 14 October 2024, the UK government announced these thresholds would be increased with the increased thresholds likely to be applicable from 6 April 2025. Further details will be announced in due course.

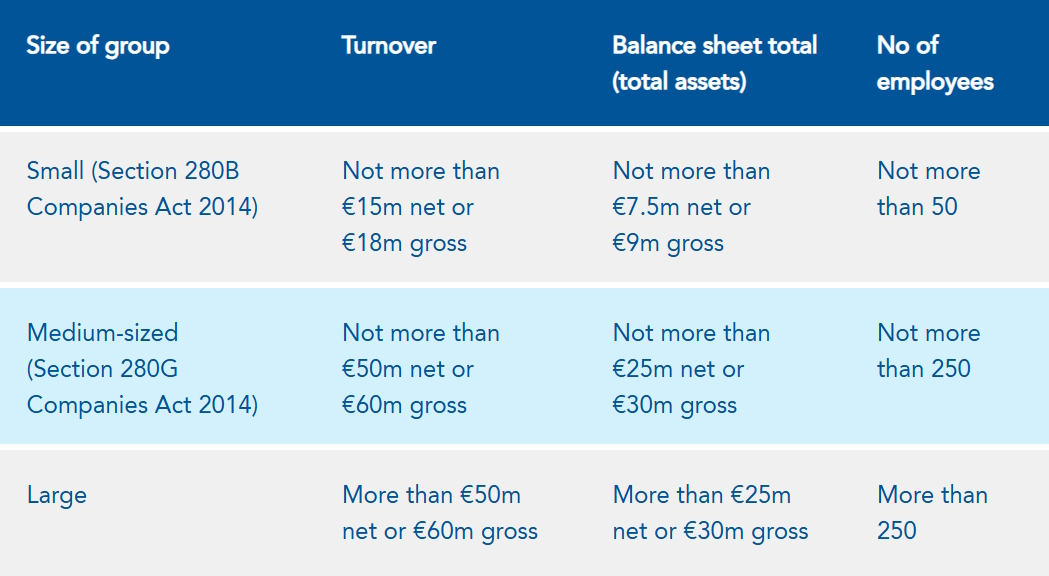

The group thresholds in Ireland are dealt with in Section 280B (small group) and Section 280G (medium group) of the Companies Act 2014. The thresholds in Ireland are relatively new having been amended by the European Union (Adjustments of Size Criteria for Certain Companies and Groups) Regulations 2024 (SI 301 of 2024). They apply to financial years beginning on or after 1 January 2024, but a company could elect to apply them on or after 1 January 2023. The thresholds in Ireland are now:

References to "gross" in these tables mean the effects of intra-group trading have not been eliminated, whereas references to "net" mean the effects of intra-group trading have been eliminated.

Key focus

The size of a group must be carefully considered. This is because a parent entity can only qualify as a small entity if the group headed by it also qualifies as a small group. Hence, if the parent could qualify as small, but controls a medium-sized subsidiary, the parent cannot be classed as small. In assessing this, the group may use either the net or gross thresholds in the table above.

Want to dive deeper into the complexities of group accounts? This article is adapted from Steve Collings’ 4-hour CPD course, Group Accounting. Learn about consolidation, thresholds, exemptions, and everything you need to manage group financial statements with confidence.

You need to sign in or register before you can add a contribution.