2022 Update: Australian Tax, Reporting & Regulation

This course provides you with an update on major changes in tax, superannuation and employee status, and allows you to consider the impact of these updates on yourself, your business and your clients.

This course is not currently available

This course will enable you to

- Get up to date with recent changes to tax, the latest announcements, and how these affect businesses

- Explore the proposed changes to tax residency rules at both corporate and individual level

- Discover the changes to superannuation brought about by the 2021-22 Federal Budget

- Consider how financial reporting requirements have changed, and how you can ensure that your corporate clients remain compliant

- Understand the current changes regarding employee status and taxation, including flexible working arrangements and minimum pay entitlements

About the course

In recent years, COVID-19 has been the main focus of news reports across the world, which has often overshadowed news and updates in other areas. During that time, multiple changes have been made to tax, superannuation and employment regulation. Make sure you are aware of these changes and those that will occur in the near future.

This course provides you with an update on major changes in tax, superannuation and employee status, and allows you to consider the impact of these updates on yourself, your business and your clients. You will learn about changes in tax residency rules, recent superannuation amendments, and current rules regarding employment.

Look inside

Contents

- Tax

- The importance of residency

- Tax residency for individuals

- Tax residency for corporations

- Temporary full expensing

- Corporate loss carry back

- Patent box

- Superannuation

- First Home Super Saver Scheme

- Repealing the work test

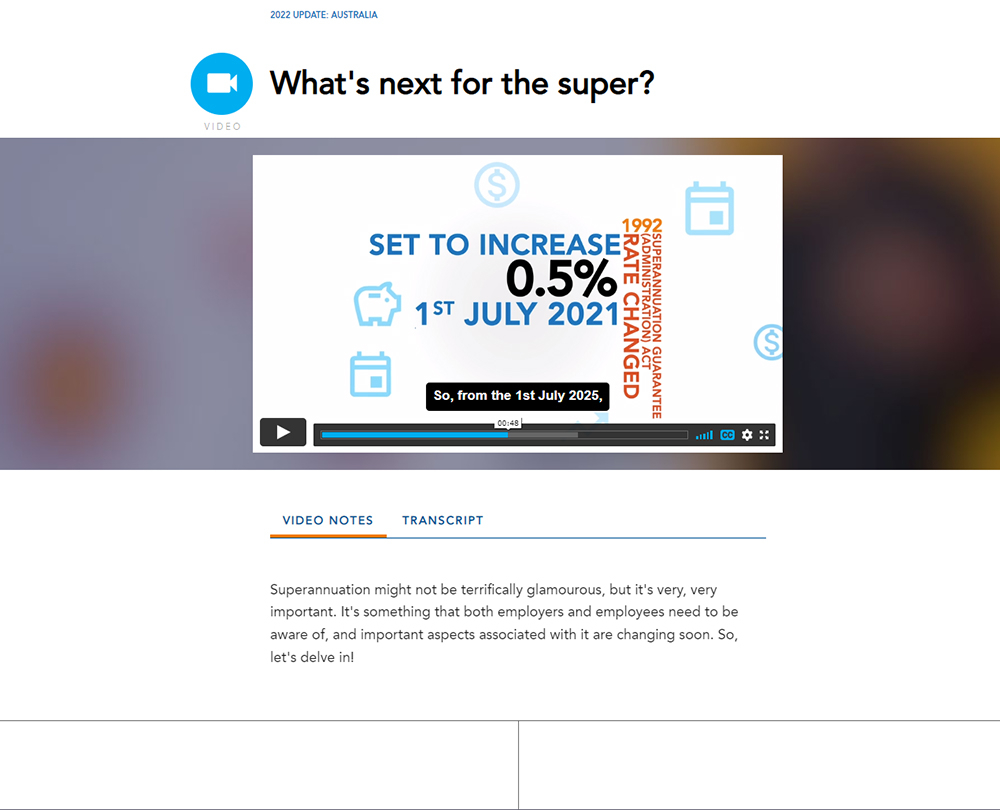

- What's next for the super?

- The superannuation guarantee

- Proposed residency changes for Self Managed Super Funds

- Financial reporting

- A new purpose

- Removal of Special Purpose Financial Statements

- Climate reporting

- Classification of current and non-current liabilities

- COVID-19 related rent concessions

- Employment

- Staying flexible

- Flexible working arrangements

- Minimum pay

- Employee share schemes

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

This course is not currently available. To find out more, please get in touch.