2021-22 Update: IFRS

In the last year there have been many updates to and clarifications of IFRS, many as a result of the pandemic. Make sure you are up to date with all the key changes, updates and new guidance.

This course is not currently available

This course will enable you to

- Stay on top of all the key changes, updates and new guidance in IFRS this year

- Understand the accounting challenges of cloud computing and the associated IFRIC guidance

- Recognise the potential problems, reporting and disclosure rules of reverse factoring

- Understand how the COVID-19 pandemic has impacted leased assets and lease revenues and how IFRS 16 has been used to overcome the issues

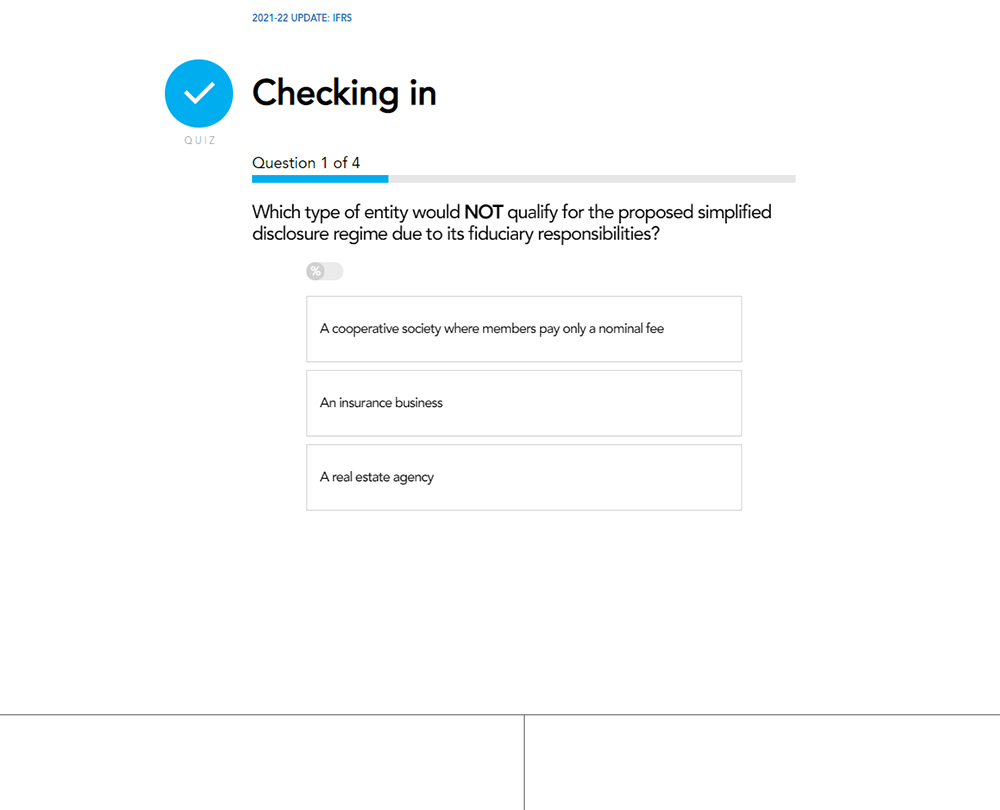

- Identify the main features of the proposals for reduced disclosures in the Exposure Draft

About the course

This year has seen a range of updates to and clarifications of IFRS, many as a result of the pandemic. Make sure you are up to date with key changes, updates and new guidance.

This course describes recent developments in IFRS financial reporting. Find out about significant new guidance issued by the IFRIC Committee on for accounting for cloud computing and reverse factoring. Develop an understanding of the ongoing impact of IFRS 16 on assessing the impact of the pandemic on rent concessions. Finally, find out about the impact of the new Exposure Draft on subsidiary disclosures and the considerable complexities involved.

Look inside

Contents

- Cloud computing

- Advice on cloud computing

- IFRIC guidance

- December 2020 IFRIC meeting

- Accounting challenges of cloud computing

- Cloud computing clarifications

- When is an asset not an asset?

- Looking ahead

- Reverse factoring and supply chain financing

- Reverse factoring and standard setters

- Financial statements

- The statement of cash flows

- Disclosures

- The Greensill saga

- COVID-19-related rent concessions

- Rent concessions and the pandemic

- The impact of COVID-19

- IFRS 16 and the "practical expedient" option

- The accounting impact

- Presentation and disclosure

- COVID-19 rent concessions

- Subsidiary disclosures

- Main features of the ED

- Alternative approaches

- Standard setters and subsidiary disclosures

- List of reduced disclosures

- Impact of reduced disclosures

- The benefits of subsidiary disclosures

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

This course is not currently available. To find out more, please get in touch.