2021-22 Update: UK Tax

UK only. Familiarise yourself with the changes and legislation that the new tax year brings. Learn about the key updates in personal, business, capital, and indirect taxes, as well as the latest on Covid-19 support measures and Making Tax Digital.

This course is not currently available

This course will enable you to

- Stay up to date with all recent UK tax changes: personal, business, capital and indirect taxes

- Advise on the latest on employee home-working expenses and tax efficient savings

- Get to grips with the new IR35 rules and the tax relief available on business loans

- Familiarise yourself with the changes to Business Asset Disposal Relief and the additional IHT threshold

- Make the most of Making Tax Digital for VAT, income and corporation tax

About the course

Although most of the UK's tax rates have been frozen for the 2021/22 tax year, there are still many changes and new legislation to get to grips with, much of it in response to the pandemic.

From pension contributions and NICs to business asset disposal relief and tax reliefs on business loans, this course will keep you up to date with all the changes in personal, business, capital and indirect taxes. You'll discover how to deal with the many Covid-19 support measures and get up to speed on the progress being made on the Making Tax Digital project.

Look inside

Contents

- Personal taxes

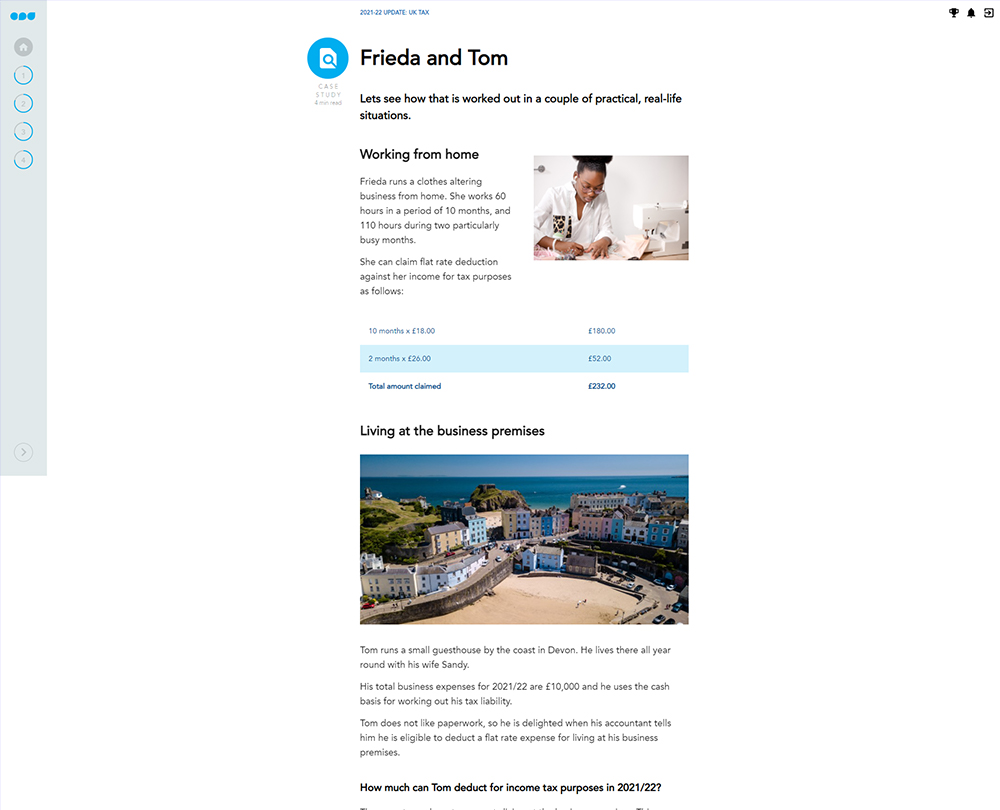

- Expenses for working at home

- Homeworking expenses explained

- Household expenses

- Pension contributions update

- Marriage allowance

- How to claim

- Tax efficient savings update

- Business taxes

- The basics of annual investment allowance

- Annual investment allowance for capital allowances

- IR35 and off-payroll working

- NICs: COVID-19 tests and veterans

- Tax relief on business loans

- Restrictions under cash basis

- Running a business from home

- Expenses checker and trading allowance

- Capital taxes

- Business Asset Disposal Relief

- Additional IHT threshold

- Gift giving and IHT explained

- Inheritance tax gifts reliefs

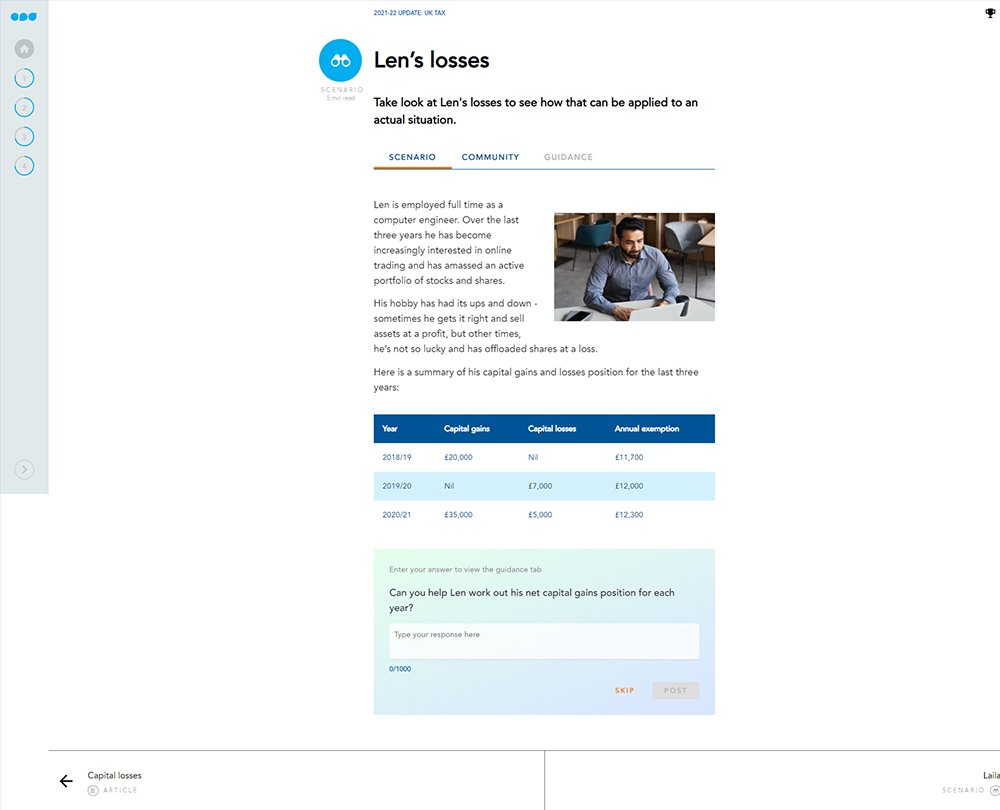

- Capital losses

- How to claim

- Indirect taxes

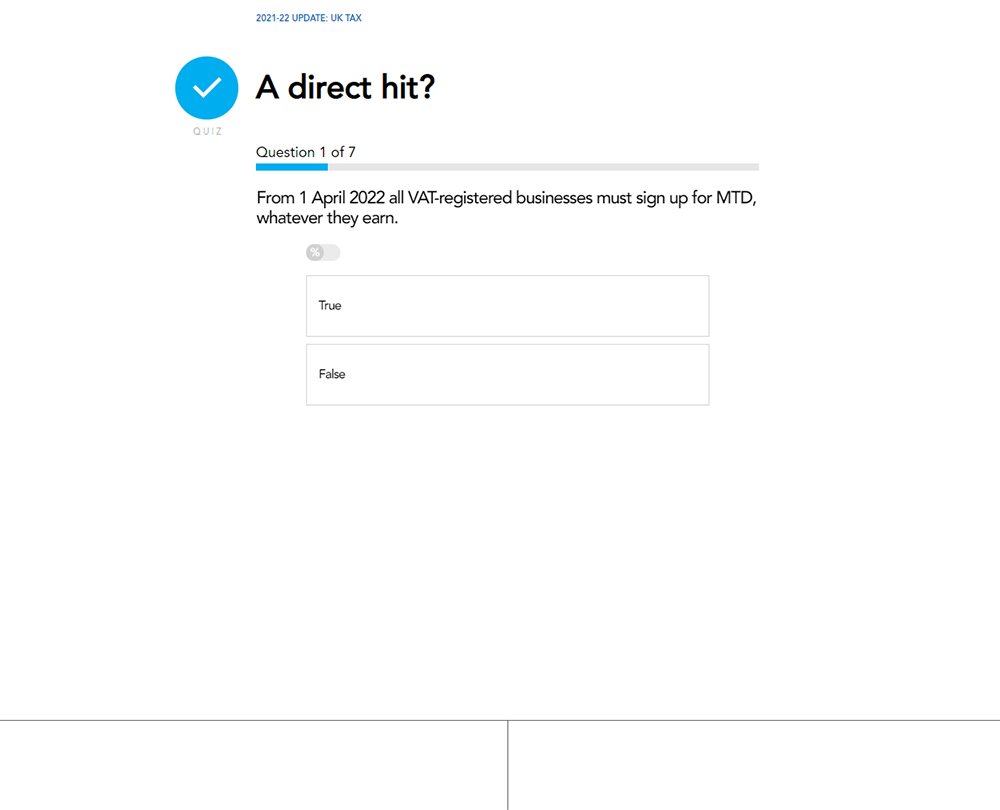

- Making Tax Digital update

- The benefits of MTD

- MTD for VAT

- MTD for income tax

- MTD for corporation tax

- Property tax in England and Northern Ireland

- Property tax: Wales and Scotland

- Business rates update

- COVID-19 support measures

- Flat rate scheme for VAT

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

This course is not currently available. To find out more, please get in touch.